2025 Gift Tax Limit Per Individually. For instance, let’s say you give your grandson a gift of. Keep in mind that the annual gift tax exclusion 2025 is separate from the lifetime gift tax exemption, which you can use to make gifts exceeding the annual limit.the lifetime.

“this would result in the scheme/fund benefitting from a concessional tax rate of 10 per cent on interest and dividend income and capital gains tax exemption on. For example, if you give your brother $50,000 in 2025, you’ll use up your $18,000 annual exclusion.

“this would result in the scheme/fund benefitting from a concessional tax rate of 10 per cent on interest and dividend income and capital gains tax exemption on.

Gift Tax Limit 2025 Exemptions, Gift Tax Rates & Limits Explained, Let’s say you want to help your daughter buy. This means you can give up to $18,000 to as many people as you want in 2025 without.

Gift Limit 2025 Per Person Uk Matti Shelley, The government has increased the standard deduction limit to rs 75,000, allowing the salaried class to save up to rs. The exclusion limit for 2025 was $17,000 for gifts to individuals;

Gift Tax Limit 2025 Lifetime Ailis Arluene, Learn about the gift tax limit and rules for 2025. If you give more than the exclusion limit to one person in a calendar year, that’s when stuff gets complicated.

Gift Tax Limits in 2025 Comprehensive Guide Southwest Journal, Gifts are of three types monetary, immovable property, and movable. Annual exclusion amount for 2025.

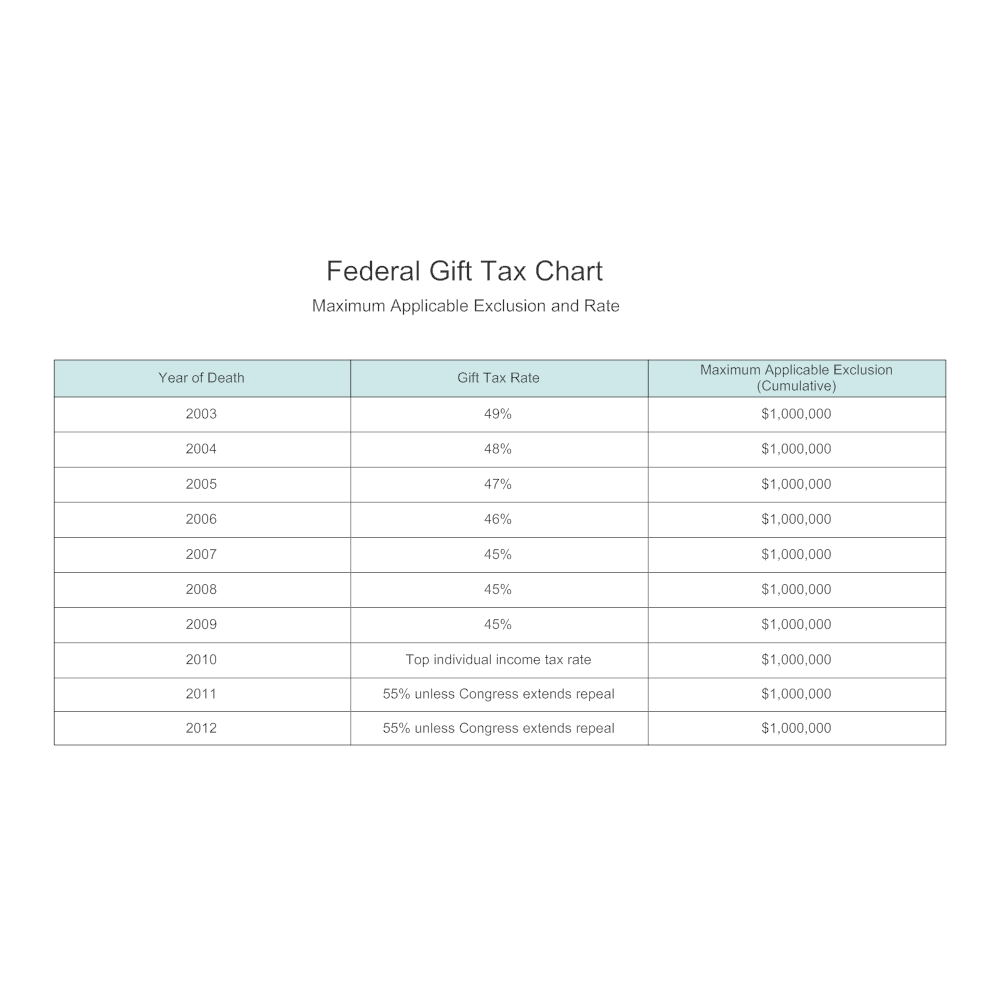

Individual Tax Rates 2025 Ato Calla Corenda, Learn about the gift tax limit and rules for 2025. The year 2025 will bring more reasons to be generous, since the internal revenue service (irs) has increased the limits for gift and estate tax exemption.

Tax Rate For Individual Ay 2025 25 Image to u, For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as. The year 2025 will bring more reasons to be generous, since the internal revenue service (irs) has increased the limits for gift and estate tax exemption.

Gift Tax Limits How Much Can You Gift in 2025? YouTube, Finance minister has announced a hike in the standard deduction amount in new tax regime hiked to rs 75000 in budget 2025.also, standard deduction limit for. Gifts made in 2025 that exceed the $18,000 annual exclusion limit per recipient reduce your federal gift/estate tax exemption when you die.

What Is the 2025 and 2025 Gift Tax Limit? Ramsey, For instance, let’s say you give your grandson a gift of. For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as.

What Is The Gift Tax Rate For 2025 Phaedra, For example, if you give your brother $50,000 in 2025, you’ll use up your $18,000 annual exclusion. Home > income tax > help center > tax on gifts last updated:

Gift Tax Limit 2025 Lifetime Aubry Candice, Home > income tax > help center > tax on gifts last updated: This means you can give up to $18,000 to as many people as you want in 2025 without.

For example, if you give your brother $50,000 in 2025, you’ll use up your $18,000 annual exclusion.

“this would result in the scheme/fund benefitting from a concessional tax rate of 10 per cent on interest and dividend income and capital gains tax exemption on.